Crop Insurance Supports Farmers, Farmers Support Crop Insurance

It was late summer when we visited Sumner Country, Kansas, where Phil White farms with his father and brother. All three farmers understand that once they put their crop in the ground, it’s out of their hands – but they also know they can rely on Federal crop insurance to get them through unplanned events […]

Celebrating 100 Years of Crop Insurance Research

Did you know this year marks 100 years of crop insurance-sponsored agricultural research? That’s right – crop insurance has supported American farmers for the last century, helping them manage risk and overcome obstacles, keeping our food supply safe and secure. In fact, over the past 100 years, National Crop Insurance Services (NCIS) and its predecessor […]

Crop Insurance Basics: Historic Drought Loss

It has been an exceptionally difficult crop year for many of America’s farmers and ranchers as drought conditions in the West and northern Plains have distressed crops and grazing lands. Approximately 210 million acres of crops are experiencing some level of drought conditions. Millions of farmers trust crop insurance to help manage their risks, including […]

Responding to Drought: Crop Insurance’s Proven Track Record

As America’s farmers and ranchers face severe drought conditions, we’ve been reflecting on the historic drought that swept across American farmland in 2012. That disaster showed just how efficiently the Federal crop insurance program can deliver aid when everything is on the line for America’s farmers. Former USDA Under Secretary Michael Scuse commended the crop insurance […]

Eastern North Carolina farmers on long road to recovery after Hurricane Florence

WALLACE, NC – Justine Price was looking forward to a great soybean crop this fall. His beans were coming in strong, covering the fields of his eastern North Carolina farm in a lush green. Mother Nature had other plans. As Hurricane Florence approached the North Carolina coast, he moved his equipment to higher ground and […]

Record Yields, Fewer Claims in 2016

Favorable growing conditions and record yields for corn and soybean marked 2016 along with fewer losses, according to a report in the latest edition of Crop Insurance Today magazine. Only seven states – all of which are in the Northeast – had loss ratios greater than 1.0, noted “2016: The Year in Review” authors Mechel […]

Midwest Loss Ratios Soar as Indemnities Continue to Rise

Twelve states have loss ratios of at least 1.1 — meaning crop losses paid are $1.10 for every dollar received in premiums for the 2012 crop year — according to the January 21 data from the Risk Management Agency. The highest loss ratio states are in the heartland, with the top five states including Illinois […]

Will Indemnities Hit $11 Billion?

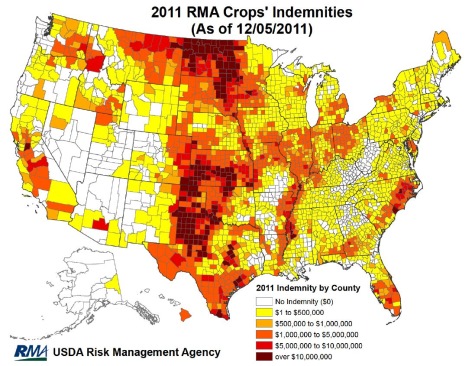

Losses paid out by crop insurance companies to farmers for 2011 crops have now exceeded $10.7 billion and are edging ever closer to the $11 billion mark, according to data from the Risk Management Agency (RMA). This surpasses the previous record of $8.76 billion set in 2008 by almost 25 percent. Spurred on by one […]

$7.1 B and Counting: Indemnities Soar In 2011

Crop insurance companies have paid out more than $7.1 billion and climbing in claims so far this year, which makes 2011 second only to 2008’s $8.6 billion in the total value of indemnities paid out to farmers. The combination of several large-scale floods in the Central U.S., record droughts in the southern plains, a strong […]

Keeping Crop Insurance Strong

The 2012 budget will likely include modifications and reductions to farm policy. Policy makers should consider 12 essential strengths that make crop insurance the cornerstone of the farm safety net programs. We’ll introduce one strength of crop insurance per month and explain how the sum of these strengths has given us the successful program we […]